working capital funding gap calculation

It shows how long cash is tied up in the companies working capital. If however the business chooses to use long term finance this flexibility is lost.

Working Capital Financing What It Is And How To Get It

This WC calculator finds the working capital ratio by using this equation.

. The company must elaborate on how to translate their own documents such as the internal business plan and market studies into the costs sales and capex figures reported in the excel template. After you have identified the best kind of funding working capital that fits to your idea to your business plans to your business development strategy surely after exploring all the information and the details about each investor funding source that provides funding working capital please make a brief and include in that brief the selected investors or lenders or venture capital firms. WACC used to calculate the funding gap.

WACC used to calculate the funding gap. This ratio measures how efficiently a company is able to convert its working capital into revenue. It is therefore important to fill the existing funding gap for SMEs and ensure an appropriate flow of bank credit to SMEs in the current context.

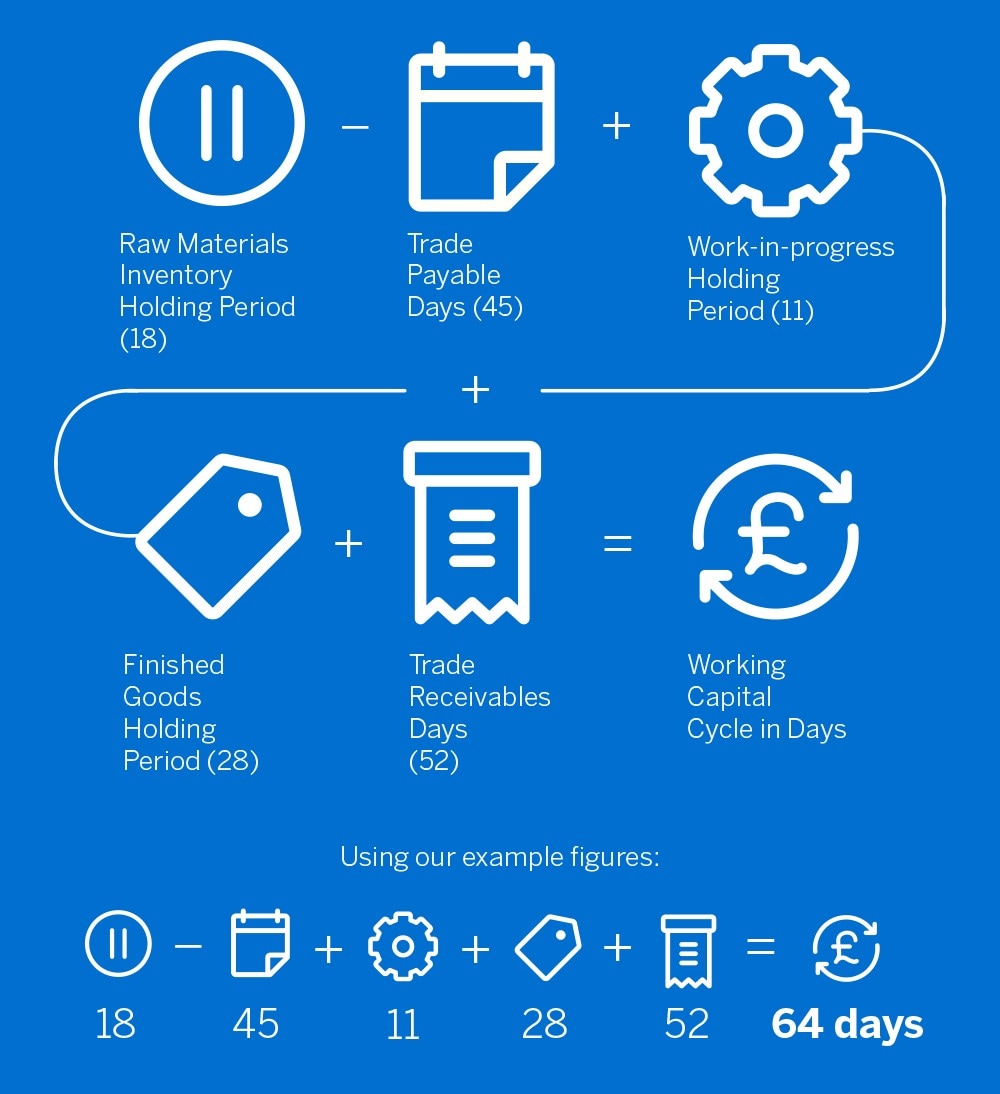

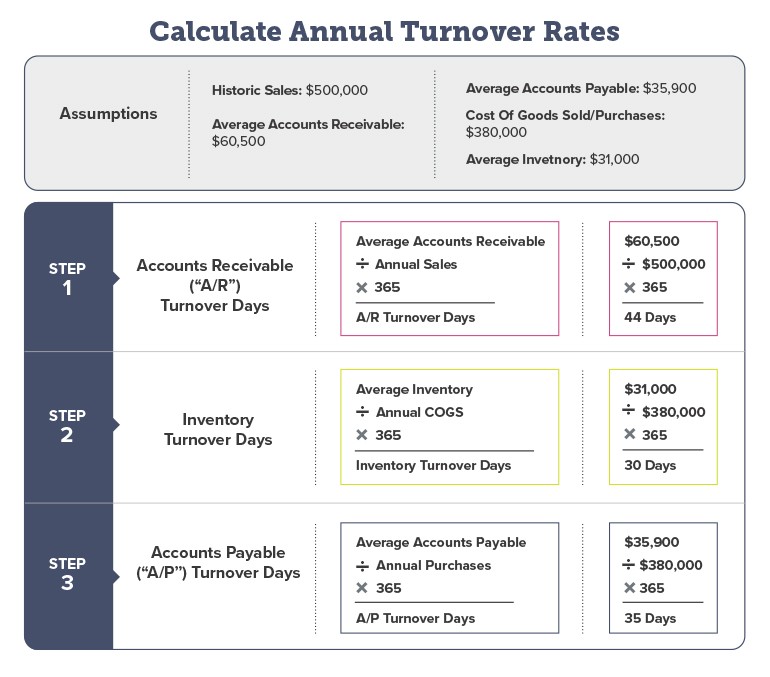

Working Capital Days Receivable Days Inventory Days Payable Days. The company must elaborate on how to translate their own documents such as the internal business plan and market studies into the costs sales and capex figures reported in the excel template. The business must now ensure it has the maximum facility 45000 at all times to fund its working capital financing requirements.

The eligibility and pre-qualification calculation is an estimate we provide you but not a final approval. Working Capital Current Assets Current Liabilities. Net working Capital Current Assets Current Liabilities.

Working Capital Current Assets - Current Liabilities. Link between the internal company documents in 3a and the data reported in the excel template. In this case its WC ratio would be.

The Working Capital Cycle for a business is the length of time it takes to convert net working capital current assets less current liabilities all into cash. Link between the internal company documents in 3a and the data reported in the excel template. The higher the number of days the longer it takes for that company to convert to revenue.

A working capital formula determines the financial health of the business and it suggests how the profitability can be increased in the future through the current ratio which we get by dividing current assets by current liabilities. The company must elaborate on how to translate their own documents such as the internal business plan and market studies into the costs sales and capex figures reported in the excel template. WACC used to calculate the funding gap.

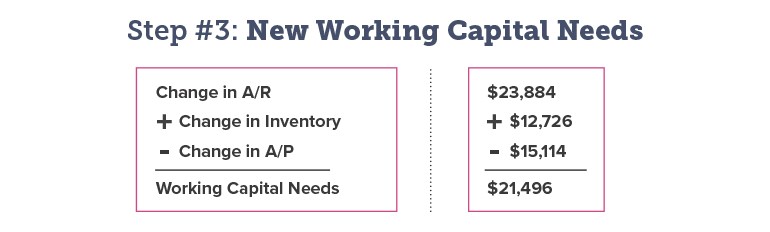

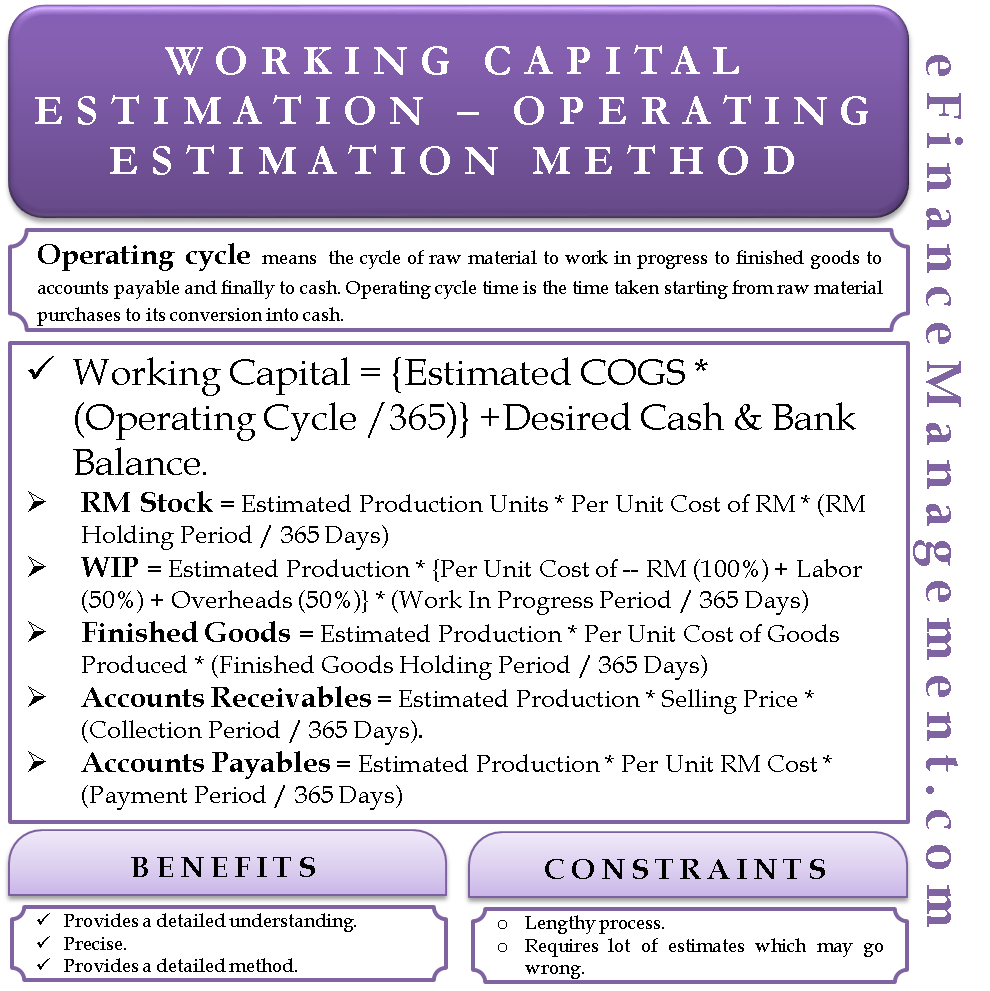

Friday June 3 2022. Here the working capital calculation considers all sorts of current assets including savings accounts stocks bonds mutual funds cash equivalents inventory items and other short-term prepaid expenses. To calculate the working capital needs one needs to use the following formula.

Working capital is often stated as a dollar figure. Assuming a company has total current assets of 100000 and total short term debts of 80000. We need to calculate Working Capital using Formula ie.

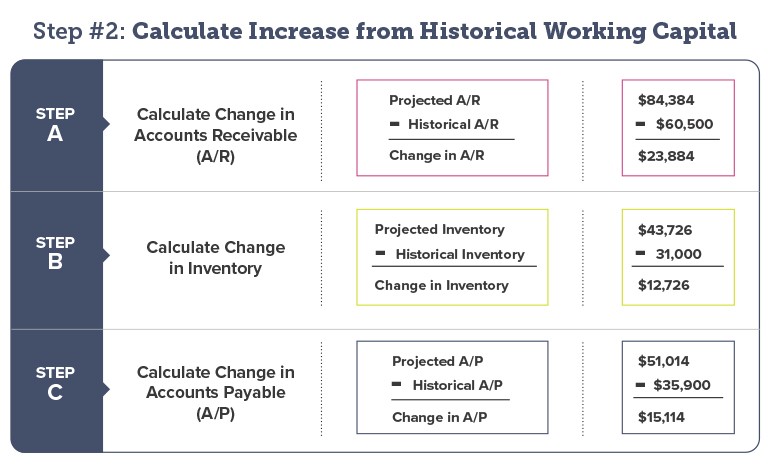

Link between the internal company documents in 3a and the data reported in the excel template. Funding provided by overhead payables 30365 x Revenue x 25 Funding required by overhead payables 30365 x 200000 x 25 4100 Rounded So the working capital calculation shows that the amount of cash funding needed reduces by 4100 because of credit given by overhead suppliers. Final terms offered and final approval may differ from the results shown in the calculator and will be sent to you only once an application is completed and reviewed by.

Working capital funding gap calculation. Working capital ratio Current assets Current liabilities. The Committees now finalised Basel III reforms complement these improvements to the global regulatory framework.

Average requirement 20000 45000-200002 32500 Finance cost 5 x 32500 1625. Funding gaps can. Negative working capital is closely tied to the current ratio which is calculated as a companys current assets divided by its current liabilities.

For example say a company has 100000 of current assets and 30000 of. A funding gap is the amount of money needed to fund the ongoing operations or future development of a business or project that is not currently funded with cash equity or debt.

Working Capital Requirement Wcr Agicap

Working Capital Cycle What Is It With Calculation

Days Working Capital Formula Calculate Example Investor S Analysis

How Much Working Capital Is Needed To Grow Your Business Pursuit

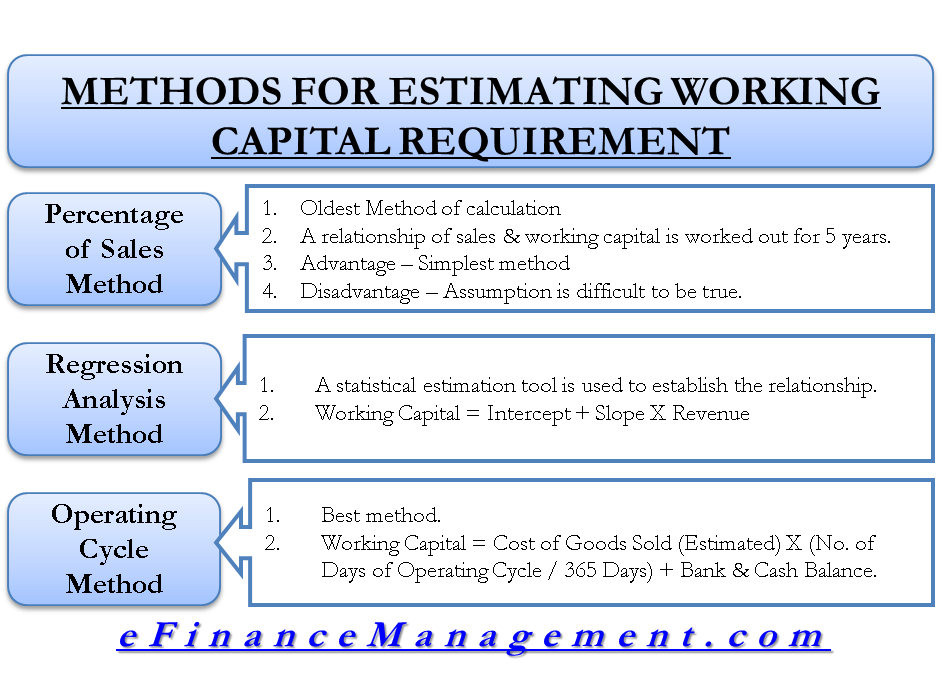

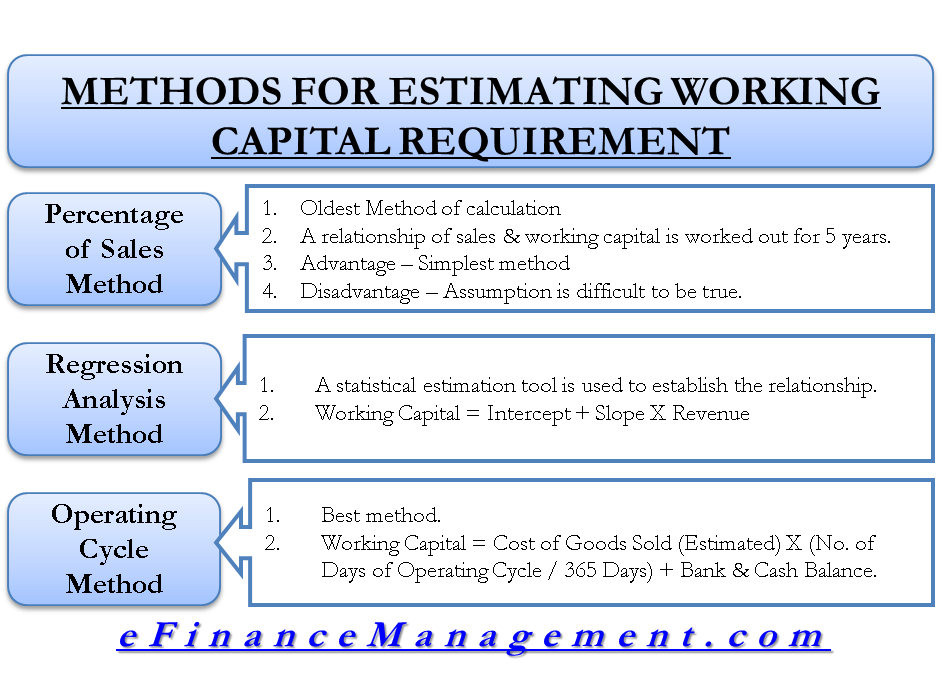

Methods For Estimating Working Capital Requirement

Working Capital Financial Edge Training

Advantages And Application Of Ratio Analysis Analysis Financial Analysis Financial Health

What Is Net Working Capital How To Calculate Nwc Formula

Modelling Working Capital Adjustments In Excel Fm

Working Capital Cycle What Is It With Calculation

Working Capital Cycle Efinancemanagement

Working Capital Formula And Calculation Exercise Excel Template

Cost Costing Cost Accounting And Cost Accountancy Cost Accounting Accounting Accounting Notes

Working Capital Cycle Understanding The Working Capital Cycle

Working Capital Cycle Understanding The Working Capital Cycle

How Much Working Capital Is Needed To Grow Your Business Pursuit

How Much Working Capital Is Needed To Grow Your Business Pursuit

Working Capital Estimation Operating Cycle Method

How Much Working Capital Is Needed To Grow Your Business Pursuit