ny paid family leave tax opt out

May opt out of paying PFL payroll contributions if you do not expect to work long enough to qualify for PFL. BOND with a newly born adopted or fostered child CARE for a family member with a serious health condition ASSIST loved ones when a family.

Get Ready For New York Paid Family Leave In 2021 Sequoia

Hofstra University will collect the cost of Paid Family Leave through.

. Im a healthy single male in my 20s so I dont see the benefit of. Workers Compensation Advocate for Business. Opting Out of Paid Family Leave 12 NYCRR 380-26 a An employee of a covered employer shall be provided the option to file a waiver of family leave benefits.

1 Obtain Paid Family Leave coverage. That is the benefit is paid for by non-faculty employees. Paid family leave tax opt out in Washington.

NY Paid Family Leave. Can Employees Opt-Out Of NY Paid Family Leave. In November 2021 Governor Kathy Hochul signed legislation to further strengthen Paid Family Leave by expanding family care to cover siblings effective.

Employer must keep a copy of the fully executed waiver on file for as long as the employee remains in employment with the covered employer. Please see the form at the link below if you want to waive the coverage. When practical employees should provide 30 days advance notice of their intention to use Paid Family Leave.

I am currently remote working from Texas for a company based out of Washington. 3 Complete the employer portion of the Paid Family Leave request form when a worker applies for leave. So if you are an eligible employee working for a Covered Employer then you have to have Paid Family Leave.

The Workers Compensation Board has a dedicated. Pursuant to the Department of Tax Notice No. Generally the reason youd want to opt out is that you pay a premium from your paychecks to be covered and waiving it.

You can read more about those excluded classes here. Seasonal may opt out of Paid Family Leave. They work 20 hours per week but not 26 consecutive weeks or.

As a Public employer you may voluntarily opt into New York Paid Family Leave at any time. An employer may choose to provide enhanced benefits such as. New York Paid Family Leave is fully funded by employee payroll contributions.

Increased monetary pay out a shorter waiting period duration to collect benefits or a longer duration for benefits to be paid. As more fully set. Unless an employee meets the very specific criteria below and you are a Covered Employer they must participate in Paid Family Leave even if theyve already had children or have no living family and dont.

Payment of 67 of your salary for a max benefit of 213672 biweekly for 12 weeks. If you will not meet the service requirements for the NYS Paid Family Leave Program you may complete a waiver to opt out of family leave coverage at this time. They work fewer than 20 hours per week but not 175 days in a consecutive 52-week period.

Ny Paid Family Leave Tax Opt Out. These benefits must be secured through a carrier licensed to write New York State statutory disability. Opting-Out Of Coverage In most cases Paid Family Leave PFL is a mandatory benefit for employees who do not fall into an excluded class.

2 Collect employee contributions to pay for their coverage. Enhanced Disability and Paid Family Leave Benefits. New york paid family leave is fully funded by employee payroll contributions.

If you need assistance contact the Paid Family Leave Helpline at 844-337-6303 wwwnygovPaidFamilyLeave. I got a payroll deduction for the Washington Paid Family Medical Leave Tax from my paycheck and I was wondering if I could opt out of this. EMPLOYEE CONTRIBUTION Employers may collect the cost of Paid Family Leave through payroll deductions.

Each year the Department of Financial Services sets the employee contribution rate to match the cost of coverage. Requirements for other types of employers are dependent upon the type of. If you have questions please call Audra Cornelius at 315-792-71947 or email her at cornelalsunypolyedu.

Employer must keep a copy of the fully executed waiver on file for as long as the employee remains in employment with the covered employer. In 2022 the employee contribution is 0511 of an employees gross wages each pay period. Paid Family Leave Helpline.

A public employer is defined as the State any political subdivision of the State a public authority or any government agency or instrumentality. While NY-based employers can choose to provide optional DBL coverage for their out-of-state employees they cannot provide Paid Family Leave out-of-state. New York Paid Family Leave is insurance that is funded by employees through payroll deductions.

New Yorks Paid Family Leave program is designed to be entirely employee-funded. And employers headquartered outside of New York need a DBLPFL policy for their New York. New York designed Paid Family Leave to be easy for employers to implement with three key tasks.

I When his or her regular employment schedule is 20 hours or more per week but the employee will not work 26 consecutive weeks or. In 2016 New York enacted the nations strongest and most comprehensive Paid Family Leave policy so working families would not have to choose between caring for their loved ones and risking their economic security. The maximum annual contribution is 42371.

PFL-Waiver - Employee Paid Family Leave Opt-Out and Waiver of Benefits. Employees can opt out of Paid Family Leave if they do not expect to work for their employer for this minimum amount of time required for. If the employee satisfies.

The maximum employee contribution in 2018 shall be 0126 of an employees weekly wage. Paid Family Leave is a mandatory benefit for employees who do not fall into an excluded class and work at a Covered Employer just like DBL. New York State Paid Family Leave provides job-protected paid time off to employees who need time away from work to.

N-17-12 Paid Family Leave benefits are taxable. Paid Family Leave coverage for non-represented employees can be determined by the Public Employer. To opt out you may complete a PFL waiver httpswww1nycgovassetsdcasdownloads pdfagenciespfl_waiver_nycpdf and submit it to your Human Resources HR representative.

Taxes will not automatically be withheld from benefits but employees can request voluntary tax withholding. If an employee waives coverage they will not make contributions and will not be eligible for paid family leave benefits. Opting Out Payment Rate Schedule Benefit 2022.

Coverage is based on where an employee physically works not where the employee lives. Get answers to your questions or other assistance on Paid Family Leave by calling the toll-free Helpline at 844 337-6303. There are a few instances where an employee can opt-out.

EMPLOYEE OPT-OUT OF PAID FAMILY LEAVE BENEFITS. Paid family leave is the vacation time you get if you have a new kid or you have a seriously ill family member you need to go take care of.

Ny Paid Family Leave Opting Out Shelterpoint

Cost And Deductions Paid Family Leave

Ny Paid Family Leave Opting Out Shelterpoint

New York State Paid Family Leave Cornell University Division Of Human Resources

New York Paid Family Leave Resource Guide

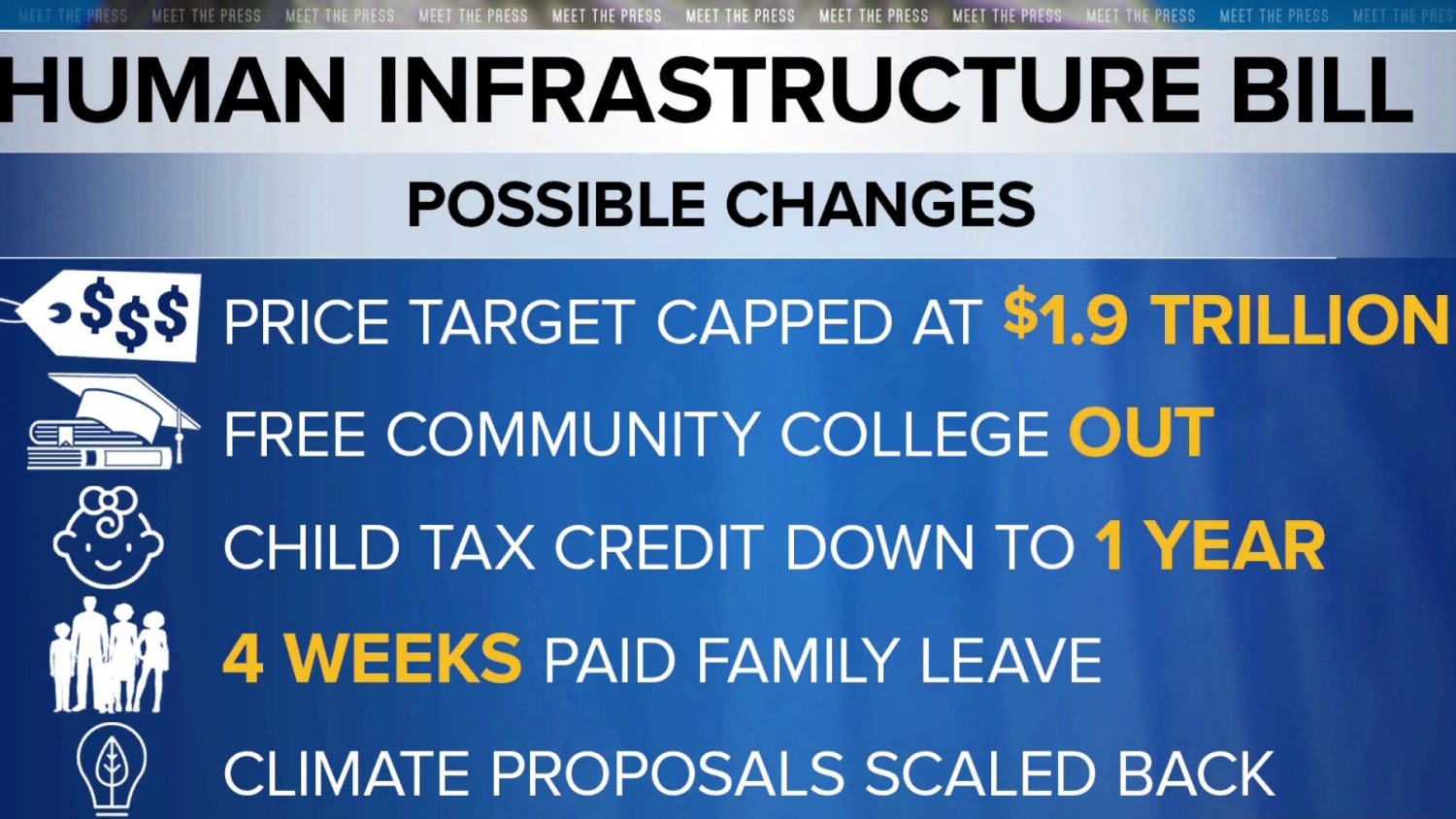

Biden S Child Tax Credit Community College And Paid Family Leave Plans May Be Cut

New York Paid Family Leave Resource Guide

Ny Paid Family Leave Opting Out Shelterpoint

Cost And Deductions Paid Family Leave

Time Off To Care State Actions On Paid Family Leave

Your Rights And Protections Paid Family Leave

Ny Paid Family Leave Eligibility Shelterpoint

Nys Paid Sick Leave Vs Nys Paid Family Leave

Update New York State S Paid Family Leave Program

New York State Paid Family Leave Takes Effect January 1 2018 Are You Ready Perlman And Perlman